Think about options exchange for beginners while the including learning how to push – your wouldn’t start on a formula step one track and you also shouldn’t start with state-of-the-art options tips. Begin by effortless actions, report trade to apply and you will slowly raise difficulty as you obtain sense. Just how much chance do you deal with as well as how far financing would you afford to remove. Alternatives trading concerns exposure therefore need to be ready to lose certain or all your investment. By mode your own chance tolerance you could potentially determine the right position proportions and you may trade method to control your risk.

Possibilities change from Holds by being naturally distinctive line of money auto. Brings show ownership inside a buddies, whereas options are deals that provide the best, yet not the obligation, to shop for or promote a stock during the a fixed price. The brand new Long Straddle needs a bigger direction regarding the inventory price becoming profitable as a result of the price of each alchemy trade in other possibilities, so it’s a premier limits bet on following industry turbulence. As the day marches to the, options’ date worth lowers, to experience for the benefit of the brand new Iron Condor, and that aims to close their reputation for less than the newest premium it gathered. The fresh versatility for the method enables changes that may extend the newest profit range, comparable to the fresh bird changing the wingspan to make use of other air currents. Still, of these ready to buy the shares, it’s a keen artful way to potentially and get him or her less than market value when you are generating income.

Having fun with Much time Phone calls: alchemy trade in

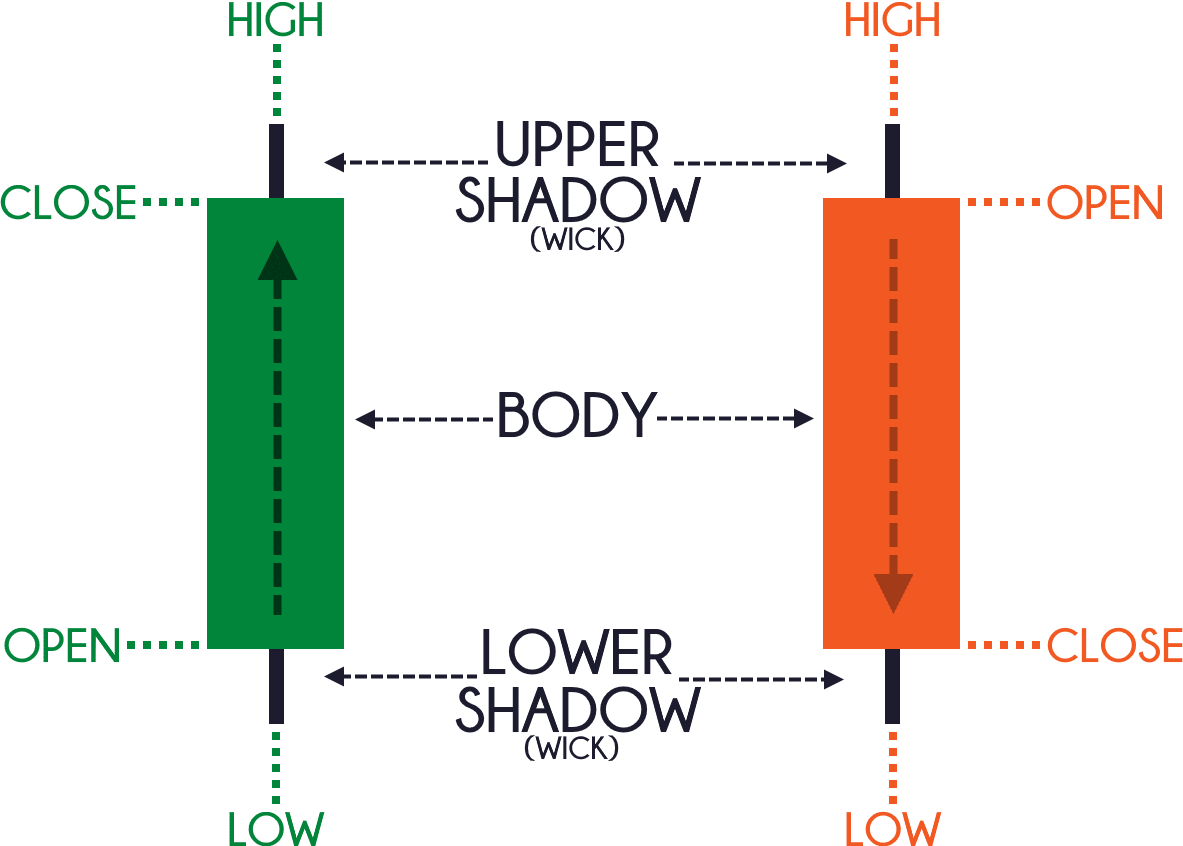

One to offer is short for 100 shares of one’s investment’s fundamental inventory, and also the price of these possibilities is actually contingent to the advantage’s speed, the amount of time up to conclusion, and also the strike price. For options exchanged on the a move, whenever a choice consumer decides to get it done the possibility it is allotted to a choice merchant to satisfy the new terms of the fresh offer. Choices change tips suggest blueprints to have building ranking to try out a good listing of business criteria and funding wants.

Factors Ahead of Change Possibilities

Ultimately, you might still remove a small, but it acquired’t end up being up to you would have lost with just the brand new stock money. Market value production are based on the earlier-date closure market value, the mediocre of one’s midpoint bid-ask rates from the 4 p.meters. Market price productivity do not portray the brand new output a trader manage found if offers had been exchanged in the some days.

If your supplier doesn’t have the newest shares inside their account, the customer continues to be provided shares, nevertheless the vendor are tasked a primary reputation from the protection. It investor is usually bearish, pregnant the price of the root inventory to fall otherwise move laterally. If your inventory price drops otherwise motions laterally, the fresh trader features the newest superior. Yet not, the decision vendor is liable to your buyer to sell shares during the strike rate should your root inventory goes up above you to rates, before the choices bargain ends. That it natural trading strategy requires the individual having a call-and-away alternative with different strike rates but the same root asset and you will termination time. The theory try dependent around profiting from predicts from the perhaps the inventory speed have a tendency to vary rather via highest market motions.

Vega means exactly how much an option’s rates vary which have a-1% change in the new designed volatility of one’s fundamental inventory. Implied volatility procedures simply how much the marketplace believes a valuable asset usually fluctuate inside really worth subsequently. A top Vega mode the option can transform within the worth easily when volatility transform. By comparison, a lot of time places and you may enough time phone calls is actually options to buy procedures. In such cases, investors expect the option to go to the money, from which area they are able to gain sometimes exercising or offering the option.

During the Fidelity, you must over an options software which explains your debts and you may spending experience, and then understand and you can indication an options arrangement. Aforementioned is called a “writer” from alternatives, and has a duty for the consumer. The brand new inquire is the price you should buy the newest quoted solution to have that have an industry purchase. Simple fact is that price of the lowest restriction buy one a good vendor away from any exchange try ready to sell the new bargain you need it. The newest bid is the rates you could potentially promote the brand new cited choice to own having a market purchase. It will be the price of the greatest limit buy you to a great customer out of any exchange are prepared to invest to purchase the brand new offer we should offer.

Consequently, gamma procedures the potential acceleration away from option prices. Options one to end from the currency is worthless no dollars change give during the termination. If your stock’s market price drops beneath the choice hit price, mcdougal is actually forced to get offers of your underlying stock from the strike rates. In other words, the new put option might possibly be worked out by option client who sells their shares from the struck rate since it is more than the new stock’s market price. Gamma (Γ) is short for the speed away from alter ranging from an enthusiastic option’s delta and the fundamental asset’s rate. Gamma suggests the amount the new delta do transform considering a $step 1 move in the underlying protection.

Thus possibilities people must be equipped with a specific level out of trust and you can understanding of the market making advised decisions. The newest higher level of influence that’s tend to obtainable in options and you will futures trading can benefit you also while the in contrast direct so you can large losings outside of the very first money. Go out rust (theta) is the speed of which an option manages to lose worth as it means termination. It has an effect on all the choices but influences short-name choices far more notably. Choices sellers make the most of day rust when you are buyers have to take into account they within their approach.

The consumer out of a choice pays a made to the vendor (or writer) for this correct. Options exchange can also be generate big earnings, or larger losings, due to financial power. The new control lets people to protect its portfolio while you are giving investors a chance to amplify winnings away from rates movements.

The fresh Bull Phone call Bequeath is actually a bright-eyed approach, best for attacks when the market’s outlook is actually promising. By purchasing a visit choice and you can promoting another with a higher hit speed, the fresh investor produces a spread that will profit from a moderate rise in the root resource’s speed. It’s a means to take the new upside while keeping a cover some dough of your own exchange, a managed bet on industry’s up trend. The brand new A lot of time Strangle technique is a technique you to smartly awaits a nice stock market knowledge. It involves possessing one another a trip and set option that have line of hit prices, making it possible for the new buyer to take advantage of big actions from the inventory rates, if up otherwise downward. This approach sits inside the readiness for an enthusiastic impactful industry density one to you’ll dramatically elevate or depress the new stock worth.

In the event where Parker Marketplace offers soar to $three hundred just after 3 months, the buyer of your own phone call solution tend to do it they. Martina obtains $215 for every display (struck price of the possibility) and certainly will support the $two hundred inside earnings on the premium, but she misses out on the enormous development regarding the stock. If the display price of Parker Marketplaces falls to help you $190 once 90 days, the customer of one’s label option will not get it done it because the it is ‘out from the currency’. Within circumstances the value of Martina’s holdings inside offers away from Parker Marketplace have reduced, but so it losses are offset by money in the superior of the name alternative one to she offered. The new Hit column shows the price from which a trip client can purchase the security if your option is worked out.

You’ll need to see the business you’re also considering change possibilities inside, to build an intelligent choice. Following that, you may make an alternative method that suits their standard. If the stock comes to an end termination during the $20 otherwise lower than, the choice often expire worthless, as well as the individual seems to lose hardly any money put in the new change. When you’re there are many a good courses for the trading choices, you to definitely shines, that’s Choice Volatility and you may Rates because of the Sheldon Natenberg, extensively seen as a vintage certainly professional alternatives traders. To obtain the choices that exist to have a particular inventory, attempt to make reference to an alternative strings.

No Comments